Why is Portfolio Diversification Important?

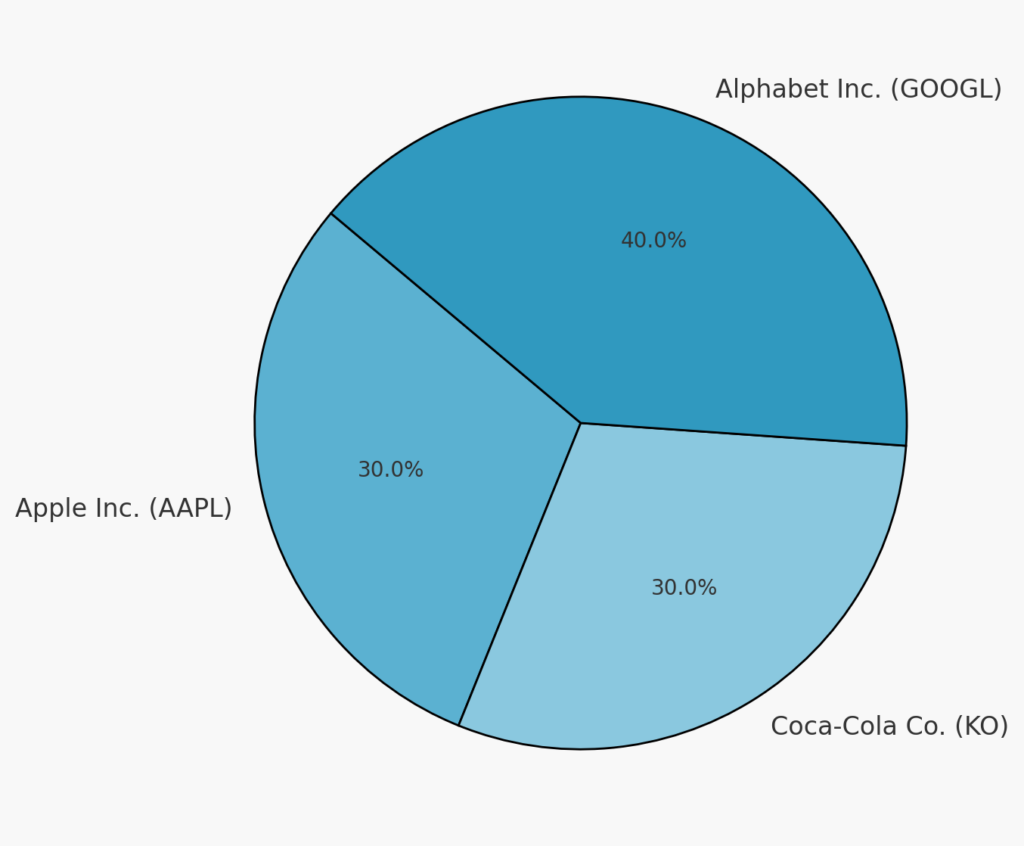

A substantial concentration within just a few stocks is one of the most significant errors we see when people invest without professional help. Not even index funds but regular, run-of-the-mill stocks. For example, 30% Apple, 30% Coca-Cola, and 40% Alphabet Inc. (Google). These well-established companies have great cash flow, and they don’t seem to be going anywhere soon – so, what’s the issue?

In this article, we’ll explain precisely why depending on just a few stocks is a bad idea and why diversification is the most reliable way to reach your financial goals.

Example of an Overly Concentrated Portfolio

What Are the Risks of Having Only a Few Stocks?

We shouldn’t assume that a corporation will maintain its current status forever, no matter its current size or strength. No corporation is invincible, and all face the risk of collapsing or filing for bankruptcy. Even if it doesn’t completely fail, a company can simply fail to adapt to changing market conditions and shrink to obscurity or just a middle-level player in the industry they once dominated.

Kodak – filed for Chapter 11 because it couldn’t see the digital world. Nokia couldn’t adapt to the smartphone era quickly enough. Internal scandals rocked Tyco and Enron. Blockbuster – well, we won’t go into tragic stories!

The point is, you never know what the headlines will reveal tomorrow that can bring a company to its knees or an invention that will disrupt an industry so much that it fades into irrelevance.

Owning just a few different stocks can put your entire portfolio at risk of mediocre returns or, in the worst-case scenario, total collapse.

Of course, you also have a lot to gain. A hefty investment in the right stock at the right time can propel your net worth into the cosmos. However, that happens too rarely to make it a relevant investment strategy. Those who get rich that way are simply lucky.

How to Avoid Concentration Risk

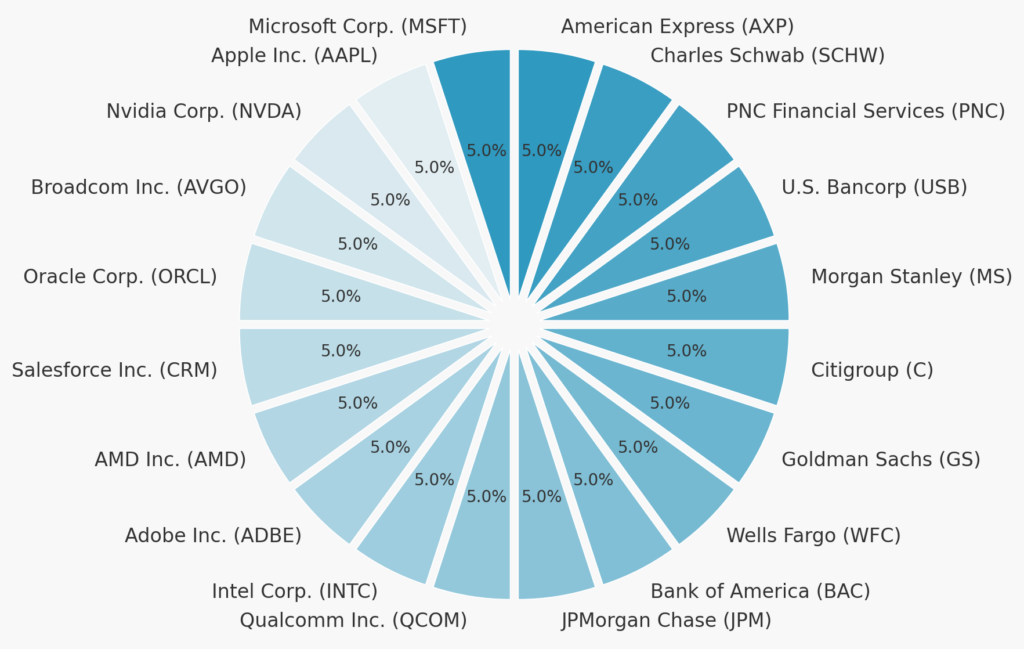

A common rule of thumb is your portfolio shouldn’t ever have more than 5% of its value tied up into one stock. Let’s say you have a $100,000 portfolio. No portion of your portfolio should be worth more than $5,000. If one stock grows disproportionately, you should either purchase more of other stocks to even things out or, as hard as it may be, sell shares of that stock (or a combination thereof).

In the portfolio above, we can see a better portfolio. No stock takes up more than 5% of the total portfolio value. However, there’s still a flaw – we only see the stock of two major industries, tech and finance.

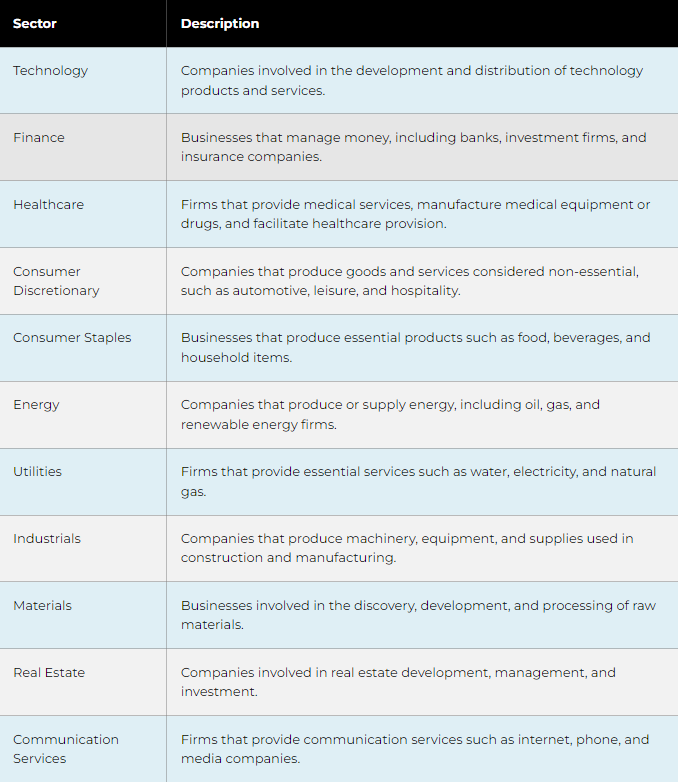

Diversification Across Asset Sectors

In March of 2003, the tech industry imploded, and a multitude of investors were left holding worthless stock. It took years for the industry to recover, and for many who had concentrated their savings in the tech industry, there was no recovery. This could have easily been avoided by simply purchasing assets across a wide range of asset sectors. Let’s look back to how a diversified portfolio would have fared when the tech bubble burst in March of 2000.

The NASDAQ Composite Index is a tech-weighted index fund that experienced significant volatility during the dot-com bubble. It peaked on March 10, 2000, at around 5,048.62 points. However, after the bubble burst, it experienced staggering losses of nearly 78%, finally reaching a low of 1,114.11 by October 2002. It took the NASDAQ Composite Index about 15 years to recover to its previous peak level. If most of your savings were invested in tech, you were likely left reeling after the bubble burst.

In contrast, the S&P 500 Index represents a diversified portfolio across various sectors. It also experienced volatility during the dot-com bubble but with less severe impacts. It reached a high of approximately 1,527.46 on March 24, 2000. Following that peak, the index declined to around 815.28 by September 2002, with losses of nearly 47%. However, it recovered to its March 2000 peak level by May 30, 2007.

Stock Market Sectors

Investors who diversified their investments across different asset sectors were much better positioned to withstand the dot-com crash and other market downturns.

Diversification Across Geographies

Sometimes, market crashes affect every asset sector and every asset class. So, we can increase our diversification even more by looking elsewhere. The U.S. may have the largest stock market in the world, but that doesn’t mean there isn’t money to be made outside of the U.S. In fact, there’s plenty to be made abroad!

World's Biggest Stock Markets by Country

Source: Visual Capitalist

While one economy might be in recession, another might be booming. By diversifying geographically, you can potentially take advantage of these varying cycles and reduce the impact of country-specific risks, such as political instability and economic sanctions, all while benefiting from currency diversification.

Additionally, emerging markets often offer higher growth potential compared to developed markets, and investing in foreign markets provides exposure to sectors that may be more prominent in other countries, such as Europe’s banking sector or Japan’s automotive industry. Plus, you don’t have to fly to Tokyo to invest in the Japanese market; diversification can be achieved by purchasing an international ETF or mutual fund with the click of a button – for example, the VXUS-Vanguard Total International Stock ETF.

In Conclusion

When you read headlines screaming that Game stop is headed to the moon or read that NVIDIA’s stock has increased by 22,640% over the last ten years (described by The Motley Fool as a once-in-a-lifetime investment opportunity), you may find it hard not to go all in as if you’re playing poker. The potential for extremely high returns certainly is there – but the odds are not in your favor.

Diversification is the mentally tougher but much safer route, and with the variety of tools available today, achieving a well-diversified portfolio is easier than ever. However, diversification isn’t the only key to long-term investment success. We still need to consider taxes, fees, portfolio rebalancing, and a multitude of other factors to make sure our funds keep working as hard as possible in our favor.