The Top 10 Reasons to Review & Update Your Will

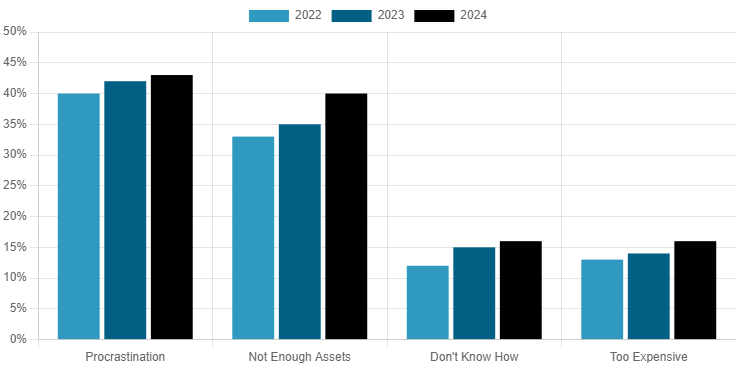

Do you need a will? The answer is undoubtedly yes. Yet, many Americans still don’t have one, despite their importance. According to Caring.com’s 2024 Wills & Estate Planning Study, 32% of Americans are without a will, citing reasons like not having enough assets, thinking it’s too expensive, not knowing how to create one, and, surprisingly, simple procrastination. At least they’re honest about it!

Just as important as having a will is updating it on a regular basis. Take a look back over the years; what’s changed? Likely a lot! Some things for the better, some for the worse. And if you have a will, have you updated it? Probably not – it’s easy to forget about that envelope in your safe or with your attorney. However, your will should constantly reflect your personal changes and evolving desires. In this article, we’ll describe the whys and whens regarding updating your will and perhaps persuade you that it’s high time for a review.

Reasons Why Americans Don’t Have a Will

Source: https://www.caring.com/caregivers/estate-planning/wills-survey

When To Review and Update Your Will

When you get married or enter into a domestic partnership, your will should reflect your happy new circumstances. If you’re not married but still want your partner to be a beneficiary in your will, you should explicitly state that fact. Without a will, your partner may not be entitled to inherit any of your assets, leaving their financial security at risk.

Be sure to review and update the beneficiary designations on your life insurance policies, bank accounts, brokerage accounts, and retirement plans after marriage as well to ensure the distribution of your assets are aligned with your current wishes. If you’ve gone through a divorce, you may want to remove your ex-spouse as a beneficiary (if you want to).

1. Welcoming New Family Members

Whenever there are new additions to your family, whether through birth, adoption, or marriage, you should update your will to reflect these changes. Step-children and step-grandchildren won’t automatically be included in the inheritance process, so their names should be included per your desires.

Additionally, if your adult children’s circumstances have changed, such as one becoming financially independent, you may want to adjust the distribution of assets to better reflect your current wishes. Perhaps now that they are independent, you’ll want a greater proportion of your assets to go to a dependent child instead.

2. Reconsidering Guardianship for Minor Children

When your children were younger, you likely chose a guardian for them in your will. However, as circumstances change, so might your choice of guardian. For example, if your oldest child is now 25 years old and you believe they would be a suitable guardian for your 17-year-old, or if your relationship with your initially chosen guardians has changed, you may want to update your will to reflect a new choice that better fits your current situation.

3. Revisiting Age-Based Inheritance Conditions

As your younger beneficiaries reach significant life events, you may want to review your will and update any stipulations you’ve set for receiving assets, such as graduating from college or achieving a particular goal. For example, if your son opted for a military career instead of college, you could revoke the stipulation that said they need to graduate from college to receive their inheritance; you may feel their service to our nation is sufficient.

Alternatively, you could alter your distribution plan to defer their inheritance until they reach a more settled or more mature phase in life. Receiving a sizable inheritance in your 20s is exceedingly more difficult to handle than one at say 40 or 50.

4. Adapting to Changing Family Dynamics

Family dynamics are complex, and over time, you may decide that certain beneficiaries should no longer inherit from your estate. Family feuds unfortunately happen, but that doesn’t have to be the case to alter the dishing out of your assets. For example, your original will might have evenly divided your assets between your son and daughter. However, your daughter is now in a much stronger financial position compared to your son, so you might want to adjust the distribution of your estate to favor your son.

Additionally, f you intend to exclude a child—whether minor or adult—from your inheritance, you must clearly state this in your will. Simply leaving their name out is not enough, as a probate court might interpret the omission as simple oversight on your part.

5. Addressing the Loss of Key Beneficiaries or Fiduciaries

The passing of a beneficiary, guardian or a fiduciary—such as your executor, digital executor, power of attorney, guardian, or trustee—certainly warrants a rapid updating of your will. If a beneficiary you’ve named in your will or on an account (like a bank account) dies before you, the asset typically reverts to your estate. It’s therefore useful to put a second beneficiary to receive that particular asset.

Similarly, if a fiduciary you’ve appointed, such as a personal representative or guardian, passes away, you’ll need to select a new individual to fill that role. If the chosen guardian of your minor children has passed away, you shouldn’t wait for a standard review of your will to update it; if you suddenly pass and you don’t have a designated guardian, your children could end up in the foster system.

6. Adjusting to Your Evolving Financial Situation

Some days we’re flush, some days we’re feeling the financial pinch, and depending on your current financial situation, your desires may be different as well. For example, if you’ve gotten incredibly lucky with a series of investments, you want want to alter your will to include other beneficiaries such as charitable organizations, more distant relatives, and maybe even friends.

7. Planning for Business Transitions

Your business ownership, whether it’s a company you’ve built or a personal investment, forms a crucial part of your estate. You can transfer your business through your will, but it’s also wise to supplement this with a detailed succession plan. This plan should outline who will take over management, how the business should be run, and any key decisions or instructions that will help ensure a smooth transition. By providing clear guidance in both your will and a succession plan, you can help minimize disruption and maintain the stability and success of the business after your passing.

8. Reevaluating the Value of Your Assets

Your estate is comprised of more than just stocks and bonds. It’s important to account for any newly acquired or sold assets, such as real estate, inheritances, or personal property like jewelry when updating your will. Consider setting up a revocable living trust as part of your estate plan to pass these assets on.

Additionally, the value of your estate significantly influences tax obligations, asset allocation, the probate process, and the basis for future sales. Keeping your will up to date with accurate valuations is crucial for ensuring your estate is managed in the most tax-efficient way possible. With the lifetime estate exemption limit set to decrease at the end of 2025 to pre-TCJA levels, any estate value exceeding the new limit could be subject to federal estate taxes. To avoid unnecessary tax liability, you should explore strategies to reduce your estate’s net worth before this change takes effect.

9. Moving to Another State

If you pack up and move to another state, you’re going to have a new address which will need to be reflected in your will; plus, different states have their own requirements regarding the validity of a will.

If your will is handwritten with only one witness, your family will be in for a difficult time when they discover your will is invalid because your new state requires typed wills and two witnesses.

When you moved, you may have sold, thrown out, or simply gotten rid of items that are in your will. If that’s the case, you’ll want to omit those to avoid any confusion. “Did Uncle Ben steal that collectible baseball card?”, some family members may wonder. Your new state may have different laws regarding your living will and healthcare power of attorney too .

10. Staying Ahead of Changes in Tax Laws

When tax laws change, it can have significant implications for your estate planning. The SECURE Act of 2019 introduced several changes, including adjustments to the required minimum distribution (RMD) age for retirement accounts. The current age for starting RMDs is 73, applicable to IRAs, 401(k)s, and other qualified retirement plans. In 2033, the RMD age will rise to 75.

Additionally, RMDs are required for 401(k) plans only if you no longer work for the company. If you are still employed and your employer does not require it, you are not obligated to take RMDs, provided you do not own more than 5% of the business you work for. It’s always a good idea to check with your plan administrator for the specifics of your current and past plans.

In Conclusion

Updating your will to reflect life’s changes is necessary, but we understand that it might seem a bit too much to revise it after every single event; not only would that be highly time-consuming but also likely prohibitively expensive considering attorney rates. However, at the very least, you should review your will whenever you have a financial check-up, which ideally should happen twice a year with a fiduciary advisor who can help make sure everything stays in sync.

We can guide you through the process to help ensure your estate plan stays current and is structured in a tax-efficient way, with the goal of preserving your wealth for future generations. Feel free to schedule a consultation by clicking the button below!