Navigating Life Insurance: A Guide for Every Life Stage

Life insurance – it’s the financial topic that many avoid like the plague, often pushed to the bottom of to-do lists or dismissed as unnecessary. Yet, it’s possession, or lack thereof, can make or break a family’s financial future. The harsh reality, however, is that millions of Americans are drastically underinsured or, worse, not insured at all.

According to the 2023 Insurance Barometer Study, 41% of American adults – about 101 million people – say they need life insurance or more coverage than they currently have. Even more alarming, 30% of those without any coverage acknowledge they need it, representing about 74 million adults walking around without a safety net for their loved ones.

One of the biggest hurdles holding people back from purchasing insurance is an inaccurate perception of cost. The study found that 50% of non-owners cite expense as the main reason for not having coverage. Yet, 55% of respondents overestimated the cost of term life insurance, believing a policy would cost $500 or more per year when, in reality, it’s typically under $200.

Proper and affordable life insurance coverage is well within reach, yet Americans consistently overestimate the cost of it. And it’s not surprising, really. Insurance policies are intricate, and the industry has, like every industry, dishonest actors that might cause people to distrust the industry as a whole. That’s why it’s important to consult with a fiduciary financial advisor on your insurance needs before sitting down with an insurance agent so you’re armed with the information you need to purchase a policy that accurately reflects your financial situation.

Term Insurance

When you visit an insurance agent, you’ll be faced with three general forms of life insurance: term, whole, or universal. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away during this term, your beneficiaries receive the death benefit. If you outlive the term, the policy expires without value. They are typically much easier to understand, come with lower premiums overall, and are ideal for covering specific financial obligations, such as your mortgage or children’s college education.

However, renewing at the end of the term may lead to premium increases, and there’s no cash value accumulation component.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides lifelong coverage as long as the fixed premiums are paid. It combines a guaranteed death benefit with a cash value component that grows at a fixed rate set by the insurer. This cash value can be accessed through loans or withdrawals and grows tax-deferred.

However, whole life insurance typically has higher premiums than term life insurance, and the cash value growth rate may be lower than that of other investment options. It may be well-suited for those seeking permanent coverage alongside a savings component.

Universal Life Insurance

Universal life insurance is also a form of permanent insurance that combines a death benefit with a savings component. Like whole insurance, universal provides lifelong coverage as long as the premiums are paid. The cash-value component accumulates cash value on a tax-deferred basis, and you have the flexibility to adjust premiums and your death benefits.

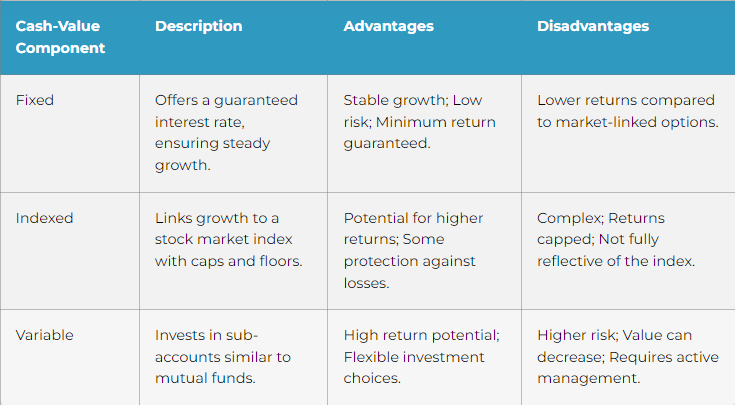

Universal premiums also tend to be more expensive than term premiums, and policies can be much more complicated to understand and manage. Many Americans see them as safer alternatives to investing due to the cash-value component that may come with a guaranteed growth rate similar to an annuity, though that’s not always the case. A universal life policy may come with one of three basic cash-value components:

Adapting Coverage to Your Life Stage

In Your 20s and 30s

Young adults often overlook life insurance, thinking it’s something for older or established families. However, this is precisely the time when securing coverage can be most advantageous, as you’re likely to get a cheaper premium. But why do you even need life insurance, especially if you don’t have a family yet? Firstly, a death benefit could help pay off any existing cosigned loans that could burden your family, such as a college loan. Also, a death benefit could be used to pay for funeral expenses or provide for someone who depends on you financially.

For most young adults, a term life policy is often sufficient and budget-friendly. You may want to consider a term that covers you until your mid-50s or 60s, by which time you’ll likely have fewer financial obligations.

In Your 40s and 50s

This is often the stage of peak financial responsibilities – mortgages, children’s education, aging parents, and retirement planning all compete for your resources. As each major milestone is achieved, you should review your insurance policy and adjust coverage as necessary.

In Your 60s and Beyond

As you near or enter retirement, your life insurance needs often decrease. Children are typically financially independent, and major debts like mortgages may be paid off. Instead, you may want to focus on the estate planning aspect life insurance can provide, such as paying for funeral expenses or transferring your estate down in a tax-efficient manner via specific life insurance products and trusts, such as an irrevocable life insurance trust (ILIT).

The Investment Angle of Insurance

Cash-value insurance is often hailed as a safer alternative to investing, not as prone to the whims of the markets. While there may be an element of truth to that, it’s also not wholly accurate. Firstly, if you find yourself unable to pay your premiums, the insurance company will pull from your cash component, and once that’s exhausted, your policy will lapse. Another issue is the ‘tax-free’ loans you can obtain from your cash value component that is likened to a pension or withdrawals from a retirement account. While it’s true that they are tax-free, you likely will have to pay the insurance company interest on the loan, either from the amount you withdrew or by taking another loan to pay that interest, which you will then owe interest on, potentially leading to a snowball effect that could quickly reduce your cash accumulation and even lead to a lapse in your policy.

It’s important to note that cash value components are often weighed down heavily by fees, which can significantly impact your returns over time. In contrast, while traditional investments like ETFs or mutual funds can be riskier, they typically generate greater gains over the long run and don’t come with the caps some insurance policies have.

With that in mind, consider how much your savings would grow in an investment account instead. Funds within a Roth account grow completely tax-free with lower fees and charges, though they come with a fair amount of risk.

Calculating Your Life Insurance Needs

The general rule of thumb suggests your death benefit should be around 10-15 times your annual income plus any debts or financial considerations, such as your mortgage and your children’s education expenses. However, if you don’t have any dependents or debt, your coverage needs could be significantly lower.

Example of Being Underinsured

A 40-year-old individual with a family earning $75,000 a year has a mortgage of $200,000 and needs $100,000 for children’s education. With a life insurance policy of only $200,000, their coverage falls short, leaving their family financially vulnerable.

Example of Being Over insured

A 30-year-old single professional with no dependents or significant debts earns $60,000 annually. Despite having no major financial obligations, they have a $1,500,000 life insurance policy, leading to unnecessarily high premiums that could be better invested elsewhere.

A thorough analysis with a financial professional can help you pinpoint the right amount of coverage for your specific situation.

In Conclusion

Life insurance isn’t a “set it and forget it” financial tool. As your life changes, so too should your coverage. However, the complex nature of insurance policies, the potential for high fees, and the risk of both under and overinsurance mean that careful consideration and regular reviews are essential. Major life events such as marriage, the birth of a child, a new home purchase, or a significant career change should all trigger a review of your life insurance strategy. As a retirement planning or estate planning tool, insurance may have a place in your portfolio, but your situation should be carefully reviewed by a financial advisor to ensure that it makes sense and that you’re not overpaying for unnecessary coverage.

Are you unsure about your current life insurance coverage or wondering if it’s time for a review? We’d be happy to fit your insurance strategy within the broader goals of your investment portfolio and financial plan. Just click the button below!