Mutual Funds or ETFs: Finding the Proper Fit for Your Portfolio

The mutual fund has a fascinating history, dating all the way back to adventurous 18th-century Dutch speculators as a response to the financial crisis of 1772–1773. In America, the mutual fund underwent many transformations before finally taking its modern form in the 1920s, culminating in the creation of the first balanced fund—the Wellington Fund—in 1929, which consisted of both stocks and bonds. You can even still purchase the Wellington Fund today on Vanguard’s website!

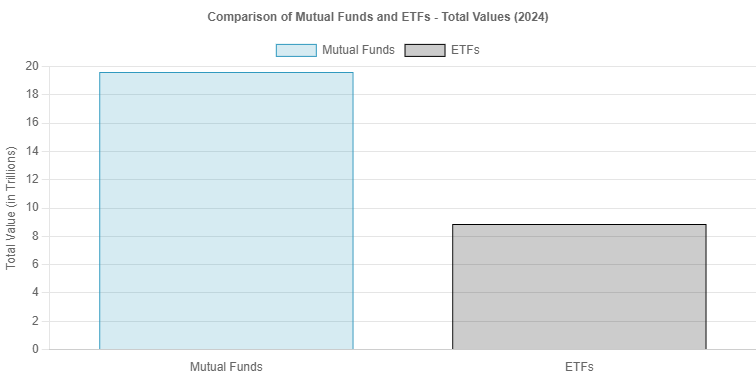

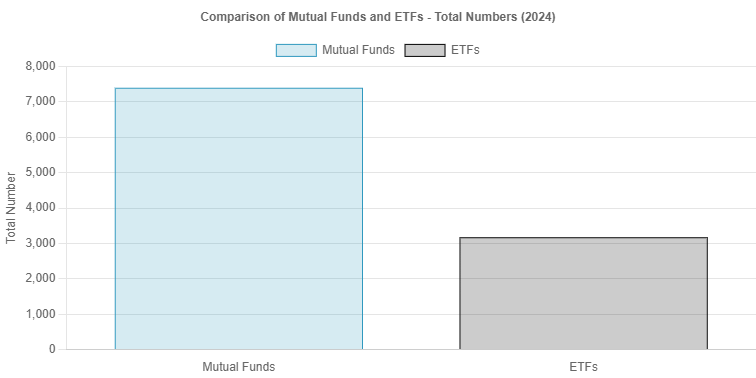

Since the inception of the first 401(K) in 1980, mutual funds have become the backbone of the American retirement system, with about 7,400 mutual funds worth $19.6 TRILLION dollars at the end of 2023. What made them so popular? Mutual funds offer excellent diversification and reduce risk by pooling investors’ money across a wide variety of market sectors and asset classes.

The ETF is the proverbial new kid on the block – first introduced in the US as the SPDR S&P 500 ETF Trust by State Street Corporation, ETFs have quickly carved out their own fair of market share, with a 2024 market cap of $8.87 trillion in invested capital within around 3,176 ETFs.

So, then, what’s the point of ETFs? Why rebuild the wheel if it’s not broken? Mutual funds have, after all, provided significant returns to investors over the years.

It all boils down to their respective functions. Mutual funds are more suitable in some instances than they are in others, and vice versa. Let’s first gain a better understanding of each.

Mutual Funds

Mutual funds, as we’ve previously stated, pool together funds from investors to purchase a bundle of investments, including stocks, bonds, debt, and money market instruments. The fund manager then actively buys and sells assets as needed to remain aligned with the mutual fund’s stated objectives, such as capturing the growth of mid-cap tech companies.

Any income earned by the individual investments, such as dividends and bond interest – is distributed to its investors on a regular schedule. Capital gains can also be distributed to the investor, though potentially with the option to reinvest. However, if the mutual fund resides within a standard brokerage account, the investor is responsible for paying both income and capital gains taxes, depending on the type of profit.

Mutual funds are not traded in the daytime like a stock or bond. Instead, orders are executed at 4 p.m. EST, when the fund’s NAV (Net Asset Value) becomes known, with the reason being that the funds’ managers are busy buying and selling individual securities throughout the trading day. When the NAV is determined, orders are executed at the same price for everyone.

Mutual funds are typically actively managed, meaning fund managers spend a large amount of time conducting extensive research on companies to invest in. For example, a fund manager may choose a benchmark index as a point of reference and then try to outperform it via active trading.

Exchange Traded Funds (ETFs)

ETFs also pool investors’ funds together to purchase various securities, bonds, and other assets. Unlike mutual funds, ETFs are traded throughout the day on the stock market exchange, like a stock. You can purchase an ETF and sell it an hour later if you’d like. Making this possible is the fact that an ETF’s price is determined by supply and demand, like a stock.

However, an ETF’s internal structure differs from that of a mutual fund. ETFs are known for their tax efficiency, thanks to a unique process called ‘in-kind’ creation and redemption. Instead of buying and selling assets within the ETF, institutional investors, known as ‘authorized participants, ’ exchange baskets of securities for ETF shares and vice versa without any cash changing hands, helping to avoid taxable events. Yes, it’s complicated.

Since individual securities are not actually purchased or sold, investors avoid some of the more common brokerage fees, helping keep costs low and the portfolio more robust overall.

However, an individual investor may receive dividends whose taxation they’re responsible for, as well as capital gains made from selling an ETF that’s risen in value since its purchase.

ETFs typically, though not always, attempt to replicate a preexisting benchmark, such as the S&P 500, otherwise known as passive management of an index fund. Fund managers aren’t analyzing the best company or industry to invest in – they’re simply adjusting the composition of the fund to remain aligned with the chosen benchmark, and failing to do so leads to ‘drift.’ Because fund managers aren’t trying to beat the market via active management, less money is spent on research trading fees, sometimes contributing to lower fees as well.

However, just as how not all mutual funds are actively managed, nor are all ETFs passive index funds.

What Should Be In Your Portfolio?

So, what are the key takeaways here? Mutual funds are typically actively managed, have greater exposure to taxable events, and may come with higher fees. ETFs seem to be the clear winner here, right? Is that why they have exploded in popularity?

Well, things aren’t that simple. Not all mutual funds and ETFs are created equal. You can find actively traded ETFs with high fees and excellent mutual funds with low fees. The correct answer may lie simply in what is available to you.

Remember that mutual funds generally face greater taxation. But that factor is either minimized or evaporates depending on the account it’s in. The annual tax obligations of a mutual fund don’t matter if it’s located within a Traditional 401(K), where taxes are deferred until retirement – and even less so if it’s a Roth 401(K), where you’ll likely never have to pay taxes on any of the dividends, income, or growth the mutual fund generates.

If taxation isn’t a factor or is less of one, our next step is to look at fees. So, have a look at what your 401(K) offers. What do the fees look like? If you see that all or most of the funds have expense ratios greater than, for example, 1.5%, you may determine that funding your 401(K) isn’t the most optimal route for your funds. For example, you could purchase more appropriate mutual funds within your IRA or a series of tax-efficient ETFs within a brokerage account.

Comparison of Mutual Fund and ETF Fees and Taxation

Your decision may also depend on your company’s match. It’s usually recommended to at least contribute up to the match to ensure full utilization of what is essentially ‘free money’ unless the fees are outrageously high.

However, if your 401(K) has a good choice of low-cost mutual funds with proven track records, you may decide to maximize your contributions and use any excess funds available to trade to purchase ETFs within a brokerage account for greater tax and asset diversification. Essentially, it all depends. We know—it’s not the cut-and-dry answer you probably want to hear, but that’s because there are so many moving parts to an investment strategy. It’s best to consult with a professional.

Why Do 401(K)s Prefer Mutual Funds?

Mutual funds have long-established regulatory frameworks and reporting standards that align well with 401(k) plan requirements. These standards include daily valuation and pricing, which ensure that all participant transactions are processed at the same net asset value. This provides greater clarity and fairness, as 401(k)s must adhere to ERISA laws that penalize discriminatory practices, such as giving management and executives wider access to investments at lower prices. This structure helps maintain an equitable investment environment for all plan participants.

In Conclusion

Mutual funds are well known amongst Americans as the go-to asset for maximum diversification and consistent long-term returns. The ETF, on the other hand, has already proven itself to be a serious contender for the investment crown. But do they really need to compete with each other?

The best choice depends on your specific situation – your 401(K) plan offerings, other investments or investment accounts, and tax situation – and they all come into play to determine the proper allocation of ETFs and mutual funds throughout your portfolio.

As experts in both investments and tax law, we can help you navigate these options to create the optimal route for your funds. Whether you’re trying to maximize your 401(K) contributions or diversify your portfolio with low-cost ETFs, our tailored advice ensures you’re making informed decisions that align with your financial objectives.