HSA vs FSA: What’s Right for You?

As medical costs continue to rise, tens of thousands of Americans fall into debt and end up declaring bankruptcy – even if they have medical insurance. With our livelihoods on the line, we have to utilize every tool possible to reduce the chances of going into medical debt. In this article, we’ll explore two accounts that can help you save for medical expenses in a tax-efficient manner and hopefully reduce the chances of becoming a statistic.

The Flexible Spending Account (FSA)

When you go to the pharmacy to pay for a prescription, what’s the tax status of the funds you use for your purchase? If you’re using an FSA, the answer would be pre-tax. You fund an FSA with your salary before paying taxes, and then you can use those funds to pay for out-of-pocket expenses for yourself, your spouse, or your dependents.

As contributions are pre-tax, you don’t owe any income or FICA tax on that portion of your income. If your salary is $50,000 and you contribute $2,000 to your FSA, your taxable income is now $48,000 (ignoring other deductions and factors). Now, instead of your funds going to the IRS, they can go to medical expenses.

Of course, there are limitations.

In 2024, you can contribute up to $3,200 to an FSA, and your contribution may even push you down a tax bracket, saving you even more money.

Qualified expenses include deductibles, co-payments, insulin, and medical devices. A notable exception is insurance premiums – no tax breaks there.

FSA Eligibility

To open an FSA, you must have employer-provided insurance, your company must offer it as an employee benefit, and you must enroll during the designated enrollment period. Your company may even contribute to it.

A significant drawback of the Flexible Spending Account (FSA) is its “use-it-or-lose-it” rule. You must spend the money you contribute within the plan year on eligible medical expenses. Any unspent funds at year’s end are forfeited, meaning they don’t roll over and cannot be withdrawn for other uses without penalties.

The Health Savings Account (HSA)

We’re huge proponents of the HSA. It can help you pay for your medical expenses with the power of the stock market, and like an FSA, it can help you save on taxes—in fact, even more so.

The HSA actually has three potential tax advantages. First, contributions are pre-tax, just like with the FSA. Second, you can purchase investments from within the HSA, and they can grow on a tax-deferred basis. Third, any withdrawals you make are tax-free as long as they are used to pay for qualified medical expenses.

What we’re saying here is that you can buy an investment pre-tax, let it compound without paying annual taxes, and then sell it without having to pay taxes on the growth – a triple-tax advantage!

Remember, though, to fully qualify for all three tax advantages, your withdrawals must be used for qualified expenses, which include:

- Dental Care: Includes major procedures like braces and routine care such as cleanings.

- Vision Care: Covers eyeglasses, contact lenses, and laser eye surgery.

- General Medical Expenses: Both small and large expenses, from regular treatments to unexpected costs.

- Postpartum Care: Covers costs related to welcoming your newest family member.

- Insurance Premiums: Payments for various types of health insurance, including long-term care, COBRA, and even Medicare.

- Healthcare-Related Travel: Expenses for travel to receive medical care, including accommodations and meals.

& More!

In 2024, contribution limits are set to $4,150 for individuals with self-only insurance coverage and $8,300 for families.

HSA Eligibility

Like an FSA, not everybody can contribute to an HSA. To qualify for a Health Savings Account (HSA), you must fulfill the following conditions:

- Have a high-deductible health plan (HDHP) effective from the first day of the month.

- Not have any other health insurance coverage, except for specific exceptions.

- Not be enrolled in Medicare. However, an individual can be HSA-eligible for the months before Medicare coverage begins.

- Not be eligible to be claimed as a dependent on another person’s tax return.

Besides the greater tax advantages and the ability to invest, the HSA has one more significant advantage – portability. Unlike the FSA, the funds in your HSA can remain there indefinitely.

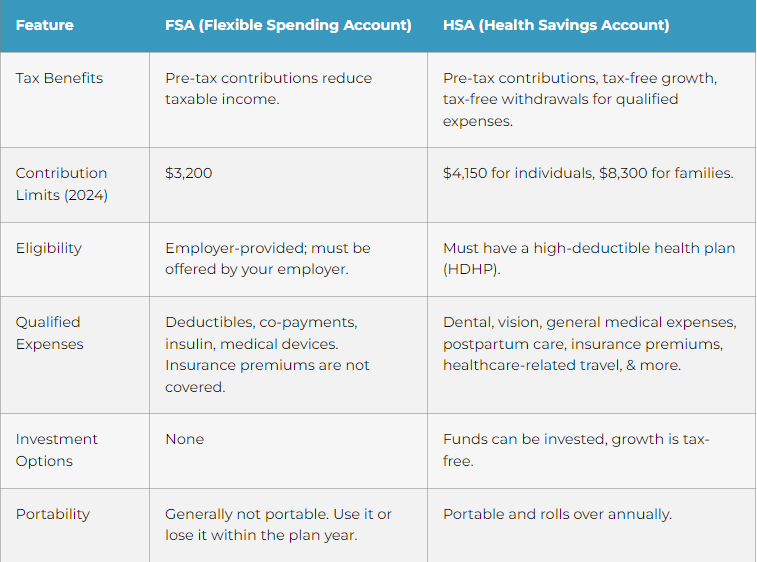

Comparison of the FSA and HSA

Can I have an FSA and an HSA?

Having both an FSA and an HSA simultaneously is technically possible – with restrictions. Typically, you can only have both if the FSA is designated as a “limited purpose” FSA, which is structured specifically for dental and vision expenses, not for broader medical costs that could be covered by an HSA. This setup allows you to maximize your tax advantages by using the HSA for wider medical expenses and the FSA for vision and dental costs, ensuring that you do not overlap the uses, which could violate IRS regulations.

What’s Better for Me?

We’re big proponents of the HSA – financial advisors and CPAs love tax-deductible, tax-free growth! But that doesn’t automatically mean the HSA is the most appropriate option for you. If you have regular, predictable medical expenses throughout the year, and you won’t have to worry about not extinguishing your funds by the end of the year, then perhaps an FSA is the most appropriate option.

Also, your investments within your HSA are exposed to the whims of the market, and you may discover that your savings have actually lost value when you go to remove them. Can you tolerate that kind of risk? However, if you’re thinking of utilizing tax-advantaged savings for long-term growth to help pay for medical expenses – that is, years or even decades – then the HSA is essentially your only option if you qualify.

In Conclusion

Choosing between an FSA and an HSA, or even combining both, depends on your specific medical, financial, and employment circumstances and may be difficult to figure out on your own. But that’s why we’re here – to guide you through the decision-making process. If you don’t qualify for either an FSA or HSA, don’t worry—we can help you craft a financial plan that manages your medical costs effectively in other ways. Together, we can help you find the best strategy for your health and your wallet.