Debt Management: Strategies to Get Ahead

America is in debt – a lot of it. In fact, one could argue that we’re in a pandemic of crippling debt that is holding households back from achieving their financial goals. The pressure to “keep up with the Joneses,” only amplified by social media, often leads us to rely on credit for purchases we may not even need, let alone afford. From the latest smartphones to designer clothes, these seemingly small indulgences can quickly accumulate into a mountain of debt as the interest begins to compound. Even high-income earners can find themselves trapped in a cycle of living paycheck to paycheck, their financial stability carefully balanced on piles of debt.

But it doesn’t have to be like that.

Financial independence is likely well within reach for those willing to embrace determination, dedication, and discipline. The key lies in tackling high-interest debt head-on and developing smart financial habits.

Americans Are In a Mountain of Debt

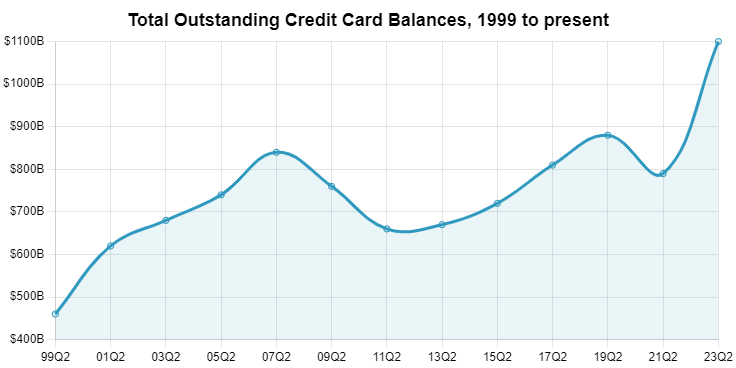

According to LendingTree.com, Americans were in 1.12 TRILLION dollars worth of credit card debt in the first quarter of 2024, with your average household holding about $7,951 of credit card debt alongside record high rates.

Of course, things don’t happen in a vacuum – there must be some reason to explain our exploding debt crisis, right? Experts have surmised that this is the blowback from COVID-19 era household budget cuts combined with the rising popularity of digital wallets that make purchasing things such a breeze (back in the days of checkbooks, it was a bit more difficult to nickel and dime yourself to death, unless you perpetually carried around cash – regardless, paying with paper is far superior to paying with plastic.)

However, things are simply getting out of control. How did we go from ‘only’ $659 billion in debt in 2014 to nearly double that within a decade? One can argue the pandemic and the subsequent inflation, but we should also look in the mirror – we like to spend too much.

So what’s the big deal? Credit cards have been around for about 70 years, and the world hasn’t come crashing down, right?

High-Interest Debt: Your Worst Financial Enemy

According to LendingTree.com, the average credit card interest rate in the first quarter of 2021 was 21.59%, and mortgages hit 7.22% in May for 30-year mortgages. If you have a ‘prime’ credit score, you can expect a 6.89% interest rate for your car loan – and it gets significantly worse if your credit score is lower. Simply put, that’s a lot of interest working against you. Especially those credit cards and private college loans, as they generate compound interest, just like your beloved ETFs and mutual funds in your IRA and 401(K). Unfortunately, the chances are high that your high-interest compounding debts are significantly outpacing your investments.

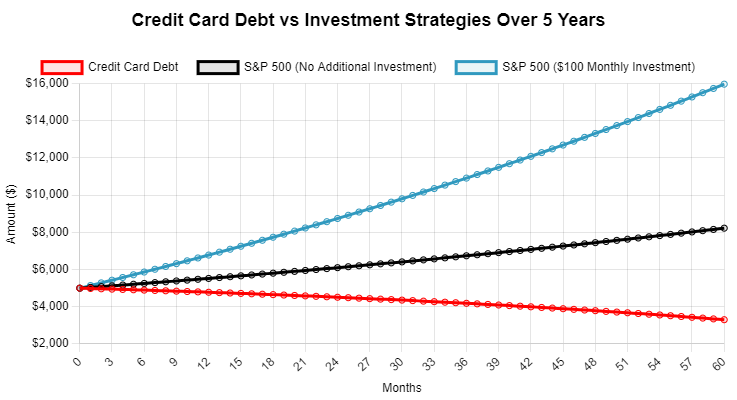

Let’s imagine you have credit card debt of $5,000, and you only pay your monthly (hypothetical) minimum of $100 a month with a 20% interest rate. At the same time, you have $5,000 invested in the S&P 500, averaging a historical 10% interest rate. What do your finances look like after five years?

After five years, you’ll have about $3,300 left on your credit card. Your investment will have grown to about $8,200. But you’re still in debt. To pay off that debt, you’d have to pay about $120 per month over those five years, and you’ll have paid about $3,360 in interest. However, if you didn’t have that debt to begin with and instead put an additional $100 a month into the S&P 500, you’d have nearly $16,000!

If you’re in high-interest debt, especially of the compounding kind, it’s vital to pay that down as fast as possible.

Budgeting for Debt Repayment

First, you need to create a budget. One popular budget is the 50/30/20 rule, which says that 50% of your budget should go to the necessities such as rent, food, and utilities. 30% should go to entertainment, and 20% should go to savings. If you have high-interest debt, though, you should attempt to reduce expenses across the board and triple down on that debt.

Yes, it won’t be fun skipping Saturday nights out with friends or forgoing meals out at your favorite restaurant, but you’ll gain other benefits, such as the reduced stress of snowballing debt. Once you begin investing, you’ll feel better and better as your savings grow faster and faster. Let the interest snowball work for you, not against you!

Debt Repayment Strategies

When it comes to getting out of debt, two popular methods can help you regain control of your finances: the Debt Snowball Method and the Debt Avalanche Method. Each has its own approach and benefits, but both require discipline and commitment.

The Debt Snowball Method focuses on paying off your smallest debts first, regardless of the interest rate. The idea is to build momentum and gain a psychological boost from seeing debts eliminated one by one. Start by listing all your debts from smallest to largest. Pay the minimum on all but the smallest, to which you’ll allocate any extra funds. Once the smallest debt is paid off, move on to the next smallest, and so on. This strategy provides quick wins that boost motivation and is simple and easy to follow, though you may pay more in interest over time compared to other methods.

The Debt Avalanche Method, on the other hand, targets debts with the highest interest rates first, which mathematically makes more sense. List your debts by interest rate, from highest to lowest. Pay the minimum on all but the debt with the highest rate, where you’ll focus any extra money. Once that debt is paid off, move to the next highest rate and repeat. This method saves money on interest in the long run and can lead to faster debt repayment overall, although it may take longer to see initial progress, which can be discouraging.

Choosing the right method depends on your financial situation and personal preferences. What’s the best one for you? Ultimately, the one you’ll stick to. If you find yourself faltering with the avalanche method, you can always switch over to the snowball method. Conversely, if you’re knocking it out of the park and feel you have the discipline to go after those larger, higher-interest debts, go for it! Evaluate your debts, consider your personality, and choose the strategy that aligns with your goals and will keep you committed to becoming debt-free.

Refinancing and Consolidation Options

If you feel overwhelmed and are still finding it difficult to pay down your debts quickly, you may want to look into refinancing and debt consolidation programs. Consolidation may drastically simplify your debt situation, which is useful if you have several lines of credit out there that only lead to confusion. Refinancing may lower your overall interest rate as well. However, beware of any fees associated with these programs – there’s no such thing as a free lunch.

Building an Emergency Fund

There’s one important factor of financial planning that we haven’t discussed yet: having an emergency fund. Imagine paying down your debts for months, making great progress, and then getting hit with a financial emergency and being forced to use your credit card again. Before you start tripling down on that credit card, be sure to have a couple of months of savings lined up first to prevent that from happening, otherwise, you could end back up where you started.

Seek Professional Advice

Navigating the journey to financial freedom can feel overwhelming, but you don’t have to do it alone. A financial planner can meticulously review every aspect of your finances and create a tailored plan to help you reduce debt and achieve your financial goals faster and more efficiently. They can guide you in prioritizing which debts to pay off first, establish a realistic budget, and, most importantly, keep you motivated to adhere to it. Plus, without professional guidance, you might miss out on valuable opportunities, such as optimizing your 401(k) contributions to take full advantage of employer matches or finding tax-saving strategies that free up more funds for debt repayment and building an emergency fund.

In Conclusion

There’s nothing more rewarding for us than guiding someone from what seems like an unfixable financial situation to a path of financial freedom. Imagine waking up in ten years with a substantial nest egg, a well-crafted budget, and a plan that lets you enjoy vacations without relying on credit cards. Picture reaching your goals without falling into unnecessary debt and looking forward to a stress-free retirement. If this is the future you envision for yourself and your family, we invite you to reach out to us by clicking the button below. We look forward to helping you achieve your financial dreams!