Asset Location Matters: How to Keep More Of Your Money

Do you feel you pay too much in taxes? We think you do! That’s why we determine what deductions we can take to reduce our taxable income and what credits we qualify for to reduce our tax bill. But did you know there’s another way to lower your tax burden? By strategically aligning your investments’ tax status with your investment accounts’ tax status, you can increase the total amount of tax-free income and help ensure your other assets qualify for lower tax rates. This strategy, also known as asset location, can drastically reduce your tax bill and improve your overall portfolio performance.

The Status of your investments

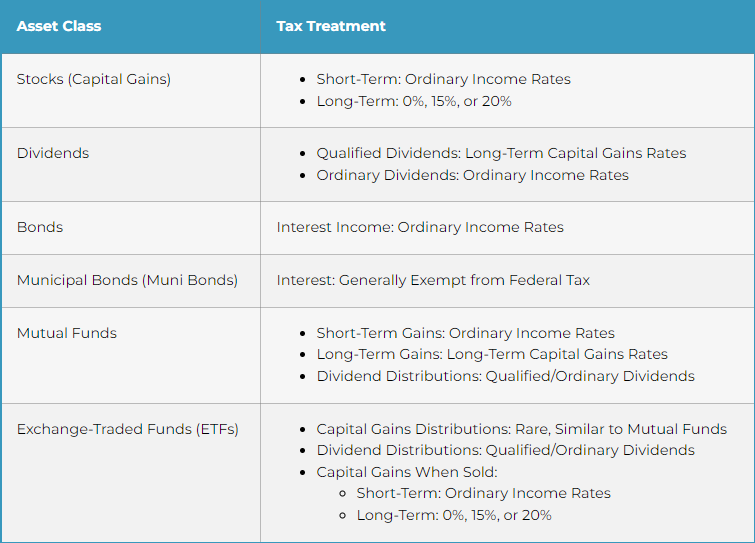

To help us create an optimized asset location strategy, we must first know our investments’ tax statuses. Here’s what you can expect to pay for each asset, assuming that they are in an ordinary brokerage account:

2024 Investment Tax Statuses

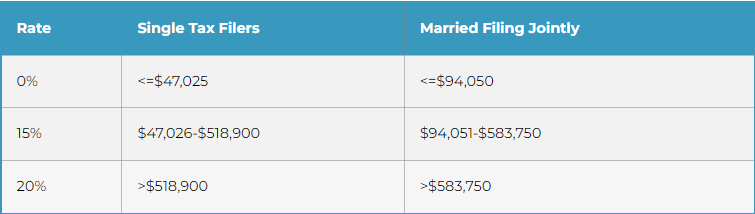

The keywords here are long-term capital gains rates and ordinary income rates, as the differences are quite stark:

2024 Marginal Tax Brackets

2024 Long-Term Capital Gains Rates

Tax Status of Investment Accounts

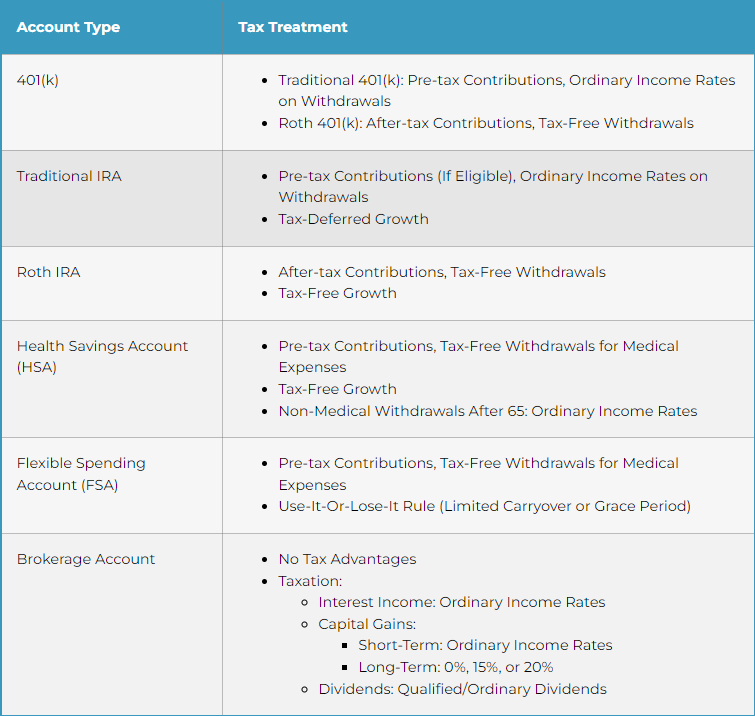

Now that we have a deeper understanding of the tax implications associated with each kind of investment let’s look at the tax rates associated with investment accounts:

2024 Investment Account Tax Statuses

As we can see, many opportunities exist to achieve a high degree of tax diversification. But why is that important? Because each asset will be taxed depending on what kind of account they’re taxed in. Let’s use the bond as an example of its varying tax rates depending on its location.

The Tax Path of a Bond

Brokerage Account

Let’s imagine that you have a bond in a regular taxable brokerage account. You don’t get any kind of tax advantage by purchasing that bond and holding it in that brokerage account. You don’t defer taxes, you don’t get tax-free growth. You pay your income taxes, purchase that bond, and then pay income taxes on the interest you receive from it every year. Not the most efficient investment process, and the constant tax drag will impede your portfolio’s performance. .

Traditional Account

A more tax-efficient way of investing would be to purchase a bond within an IRA or 401(K). In this case, you get a deduction for your contribution to your investment account, but you will pay regular income taxes on the proceeds in retirement. Here, at least, you get the deduction and less annual tax drag, unlike in a brokerage account.

Roth Account

What would happen if you placed that bond in a Roth account? You’d pay taxes on your regular income, purchase your bonds, and then never pay taxes on any of the interest you receive (assuming you follow Roth withdrawal rules). That tax-heavy investment suddenly becomes a tax-efficient investment vehicle. But it could still be more efficient.

Health Savings Account

Finally, we get to the ultimate tax-efficient account. You can take a tax deduction for your contribution, your investments can grow tax-free, and you can remove your funds without paying any taxes on the growth as long as you use them for qualified medical expenses.

The Importance of Tax Diversification

The next task is purchasing the right assets within the correct account to optimize tax efficiency. Then, when you’re in retirement, you have a greater number of accounts from which to withdraw funds. This is especially important when factoring in the taxation of your Social Security, which is affected by your taxable income.

Your Social Security is taxable only if you reach a ‘combined income’ threshold. Your combined income is the sum of your taxable income, which includes:

- Self-employment income

- Dividends and interest

- Pension and annuity income

- Taxable withdrawals from retirement accounts (like a 401(k) or IRA)

- Tax-exempt interest income (such as interest from municipal bonds)

After summing up that income, you add 50% of your Social Security income, which will be your ‘Combined Income,’ also known as your ‘Provisional Income.’

Provisional Income Thresholds

Now, the pieces all come together. You may not be able to control some aspects of your income, such as dividends within a brokerage account, but you can choose which account to withdraw from and what assets to sell to strategically ‘fill up’ your tax bracket and potentially avoid owing any taxes at all.

Let’s use an example:

Your Social Security is $20,000. That means half of it will be used to determine your provisional income.

You also have $5,000 in qualifying dividends.

Social Security: $20,000 ($10,000 to provisional income)

Dividends: $5,000

Provisional Income so far: $15,000

But you still need more money. You can now choose to withdraw funds from your traditional retirement account up until the threshold when you’d be taxed. Beyond that, you withdraw from your Roth account to fill any income gaps.

Traditional 401(k) Withdrawal: $9,600

Provisional Income: $24,600

Total Income: $34,600

Additional Withdrawals to Meet Income Needs:

Roth Withdrawal: $15,000 (Tax-Free)

HSA Withdrawal: $2,000 for Medical Expenses (Tax-Free)

Provisional Income: $24,600 (Remains Unchanged)

New Total Income: $51,600

Total AGI: $14,600

Your Tax Bill

Standard Deduction (2024, Single): $14,600

Taxable Standard Income: $0

Qualified Dividends: $5,000

Capital Gains Tax Rate: 0% (AGI is less than $47,025)

Tax Bill: $0!

Even with nearly $52,000 of income, your Social Security remains untouched, your Medicare premiums won’t increase in a couple years, and you don’t owe Uncle Sam any taxes – all made possible by having multiple kinds of assets in multiple accounts with varying tax statuses.

This may be a simplified scenario, but the principles remain the same – a careful and deliberate application of the tax code can result in a lower tax bill. Why pay more than you have to?

In Conclusion

A strategic location for your investments can do more than just lower your tax bill. By keeping more funds in your investment accounts, it can potentially accelerate the growth of your portfolio. However, understanding the exact tax rules applicable to your financial situation is crucial. This is where a financial advisor with expertise in tax law can be highly beneficial.

At Walters Strategic Advisors, we offer comprehensive financial solutions as both fiduciary advisors and CPAs. We understand the intricacies of tax laws and can guide you on which assets to purchase to achieve your financial goals, determine the most suitable accounts to hold these assets and craft a plan on how to withdraw your funds in a tax-efficient manner, ensuring that you don’t pay more taxes than necessary.

In simpler terms, we help you make smart investment decisions that reduce your tax liability to help grow your wealth faster. By leveraging our expertise in both financial advisory and tax law, we can help you keep more of your hard-earned money working for you.